Many industry experts predicted in early 2023 that “the” economy and therefore the construction industry was not going to be so well off. Construction spending went significantly up more than expected in 2023. That supported consistent employment growth.

Homebuilder sentiment improves for a second straight month, following drip in mortgage rates

This news article was posted by CNBC today. Yahoo Finance articles was “Homebuilder confidence jumps by the most in 11 months” – NAHB stands for National Association of Home Builders and trade or industry specific resources is where we need to go to find the origin of information. Builder Sentiment Surges on Falling Interest Rates.

2023 was not a bad year for the construction industry and therefore the companies despite rate hikes and all sorts of news and information.

Consumer spending in 2023 was not shabby either. Of course you got the “off-seasons” but people spend their money during holidays and airports as well as roads were busy with travelers.

2023 was not bad. How will be 2024 – Economist & US Consumer Sentiment

As I am not an Economist and only a consumer and person who pays attention, I would say that the overall consumer sentiment was pretty positive. The stock and financial markets did not bad either. Lots of money spend on investments and what came down from the isle of merger and acquisitions was not bad in numbers either.

As a research specialist for construction firms, I have seen that there were many commercial and residential construction projects on city and county level pipelines. Either as an administrative review, rezoning request, administrative approval or a plain building permits.

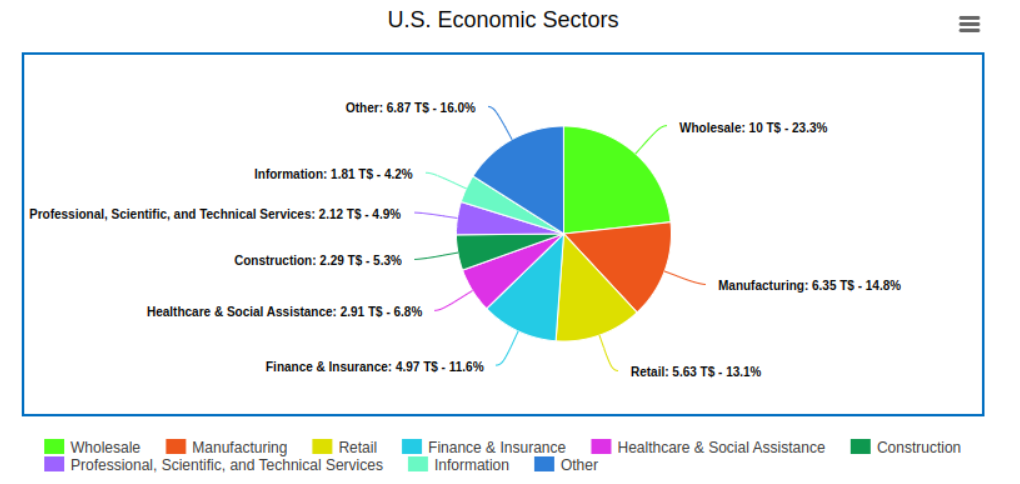

The above diagram was “borrowed” by axiomalpha and the data should have come from the Bureau of Economic Analysis. https://www.bea.gov

The US construction industry added 17,000 jobs in December 2023

according to the Bureau of Labor Statistics. https://www.bls.gov/news.release/empsit.nr0.htm BLS-Labor Statistics @BLS_gov

Construction industry employment grew 2.5 % to 197,000 new jobs in a past 12-month time period according to an analysis of BLS data by the Associated Builders and Contractors group

In December, the unemployment rate for construction workers dropped by 1.2 percentage points to 4.5% on a seasonally adjusted basis. Solid growth in 2023!

The 2024 Construction and Business Outlook!

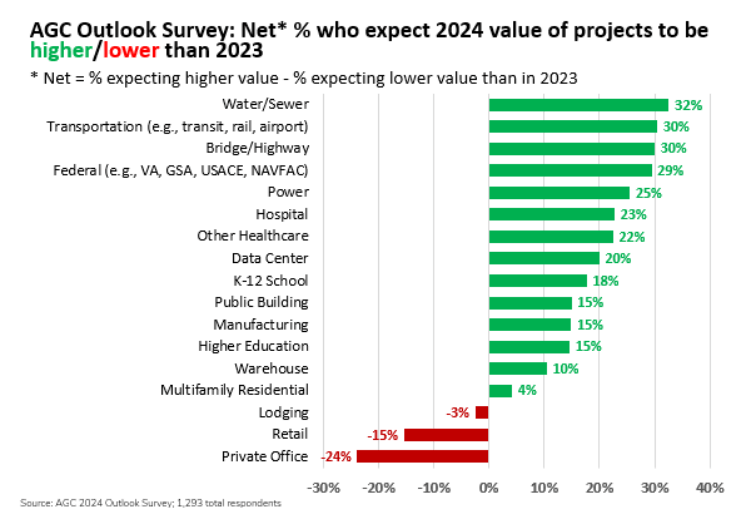

Over 27,000 companies, including more than 6,500 US general contractors (GC’s), close to 9,000 specialty-contracting firms and almost 11,000 service providers and suppliers belong to the Associated General Contractor of America (AGC).

The AGC conducted a survey and published the results at the beginning of January.

69 % of respondents in AGC’s survey said they expect to add to their headcount this year, compared to 10 % who expect to reduce their workforce. Within that, 47 % of respondents said they will grow their headcount between 1% and 10 %, while 18 % said they expect to increase their workforce by 11 % to 25 %.

77 % of those surveyed said they are having a tough time filling salaried and hourly craft positions, while a combined 55 % said they believe hiring will continued to be hard or become though in 2024.

Higher demand, Labor shortage, Increased Cost, Supply Chain Challenges

The AGC and Sage Construction and Real Estate talk about the issues to keep up with demand. Contractors continue to struggle with labor shortages, higher costs and supply chain challenges, said Stephen Sandherr, CEO of the AGC last week.

AGC CEO Stephen Sandherr said “Demand for different types of projects is changing. Respondents to this year’s outlook survey are less confident about growth prospects for many market segments than they were just a year ago. They are most optimistic about a range of public sector market segments including water and sewer projects, transportation, federal projects and bridge and highway. Conversely, they predict private sector demand will be less robust for segments like manufacturing, multifamily residential, and will also decline for lodging, retail and private office construction.”

Of a lot what will happen in 2024 depends on the Federal Reserve and if the anticipated rate cuts will take place says Zack Fritz, an economist at Sage Economics to AGC.

Zack says “A lot of companies are setting budgets now, the labor market is very tight, which is keeping upwards pressure on wages but the labor force strength is the strongest it has been since January 2021.

2023 has been strong year for construction activity. That has a lot to do with the ongoing rise manufacturing-related construction spending, which is now up 165% since the start of 2020, cites Zack.

Economists predict that the unemployment rate is expected to tick up to 3.8%. The jobless rate has been below 4% for nearly two years, the longest such streak since the late 1960s.

Residential Construction Segment

AGC members don’t build single-family housing says Ken Simonson, chief economist at the AGC. He cited Census Bureau data showing that this bellwether construction market has posted a rebound in start permits and seven straight months of higher spending for construction put in place, a positive sign. Freddie Mac also reported that the 30-year fixed mortgage rate stayed basically flat at 6.6% for two weeks in a row over the last week of 2023 and the first of 2024.

Residential construction employment now stands at 3.3 million in December, broken down into 936,000 builders and 2.4 million residential specialty trade contractors. The 6-month moving average of job gains for residential construction was 4,000 a month. Over the last 12 months, home builders and remodelers added 40,100 jobs on a net basis. Since the low point following the Great Recession, residential construction has gained 1,316,800 positions.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Alex Carrick, Chief Economist at ConstrucConnect published an article on January 8th, 2023. https://canada.constructconnect.com/dcn/news/economic/2024/01/housing-starts-u-s-and-canada-not-as-badly-battered-as-one-might-think

Another 30% rise in home construction can easily be absorbed in the marketplace!

Housing Starts, December 19, 2023

December 19, 2023By: Lawrence Yun

As home builders ramp up production, more supply will reach the market. In November, single-family home construction rose 18% from the prior month and was up a hefty 42% from one year ago. Home builders’ sales have been up this year despite high mortgage rates due to the offer of incentives on buying down interest rates and the long-held business model of offering co-op commission to buyer agents. That’s the free market way of doing business in a very competitive industry.

Another 30% rise in home construction can easily be absorbed in the marketplace, especially in light of recent weeks’ plunge in mortgage rates.

Despite their continued struggles to borrow money, commercial real estate professionals expect a rebound of multifamily sales in 2024 once long-term interest rates stabilize, according to a new survey by Berkadia.

The Berkadia 2024 Powerhouse Poll Outlook shows that 72 percent of investment sales and debt brokers expect stronger year-over-year transaction volume on institutional deals above $50 million.

Goldman Sachs expect growth in America to be robust, at 2.1 % around double the level that economists at USB foresee. Some banks see inflation falling by half in 2024. Others think it will remain sticky, only dropping to around 3 %, still well above the Federal Reserve’s target. Expectations for what the Fed will end up doing with the interest rate, accordingly, from basically nothing to 2.75 percentage points of rate cuts.

According to an article by Simon Rabinovitch writer for The Economist, America’s Economy in 2023 provided a lesson in humility for forecasters. Before the year began, almost all predicted that it was heading for sluggish growth at best, and a recession at works.

America powered ahead at an annualized pace of roughly 2% growth. The median forecast for 2024 is that America will avert a recession and get price pressures under control. This would qualify as a “soft landing”. Goldman Sachs and Morningstar expect for the fed to cut interest rates in 2024 and as early as March.

Relevant links: